Research from world class faculty

Industry practitioners that work with UCLA Samueli gain a competitive advantage.. Our faculty are responsive, innovative, and talented. UCLA Samueli is home to state-of-the-art laboratories and world renown centers. Partner companies often call upon academic resources to advance their work on- and off- campus. The industry/academic partnership is supported through both sponsored projects and gifts.

Sponsored projects

These are customized research engagements with one or more researchers. These engagements often begin with a meeting or campus visit where the company identifies a researcher (or researchers) with whom it would like to work. If there is mutual interest in a project, the researcher may submit a short proposal to the company for review. If the company is interested, its representatives work with the researcher to develop a detailed plan that covers the scope, schedule and budget for the project. This plan is then sent to the UCLA’s Technology Development Group, which works with the company to negotiate a formal legal agreement covering the project. The agreement typically includes project milestones and deliverables as well as intellectual property and other contract terms. Industry-sponsored projects are subject to indirect costs at the same level that applies to federal grants. The cost for a sponsored project varies depending on the scope. Most researchers like to get at least enough funding to support a graduate student for one year, which is approximately $70,000 annually, and does not include costs for faculty time, equipment, materials or travel.

Gifts

Some companies support UCLA Samueli research through gifts to departments, labs or programs doing work that is of company interest. Like sponsored projects, companies often identify areas they would like to support through hosted campus visits. Once the donor has decided on a recipient and an amount, then our team will work with the company to put together an agreement to document the gift.

Since a gift is philanthropic, there are no contracted deliverables or intellectual property access. The campus does not assess indirect costs for gift support, although all gifts are assessed a small administrative fee. The gift is tax-deductible. Companies may also provide gift support to the university through in-kind donations of equipment or software. In-kind donations may be tax-deductible, but the company must develop its own assessment of the value of its gift for tax purposes.

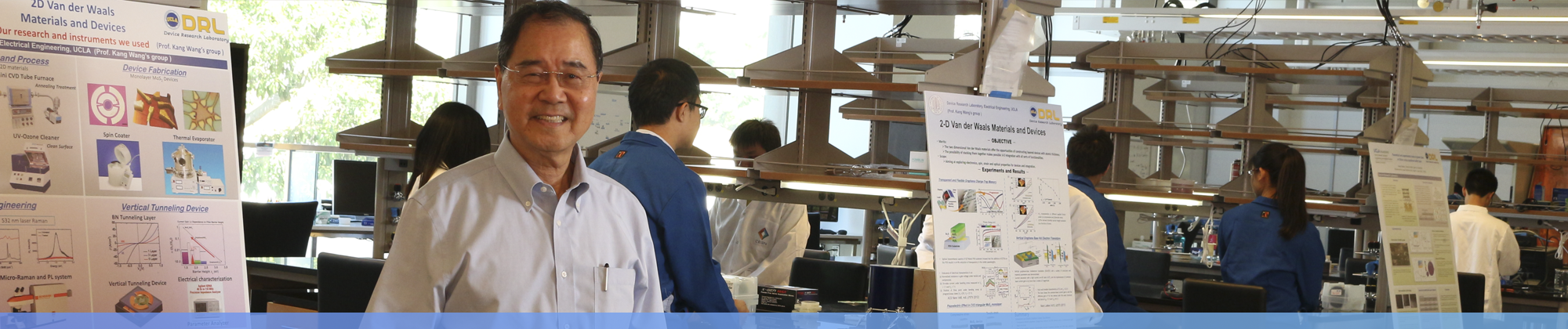

Get to Know Our Faculty

Faculty and researchers work at the forefront of their respective fields. Want to keep up with the exciting advancements happening in their labs? Check out Headlines and sign up to receive the monthly newsletter highlighting faculty research.

Learn more about our faculty with our expertise guide.

Contact Us

Helen Magid

Senior Director of Corporate and Foundation Relations

310.825.3979

hmagid@support.ucla.edu

News

UCLA Engineers Become 6-Time RoboCup Soccer World Champions

UCLA engineers dominated at RoboCup 2024 July 18–21 in Eindhoven, Netherlands, with a pair of humanoid ARTEMIS robots winning every game in the soccer tournament to snag the world championship.

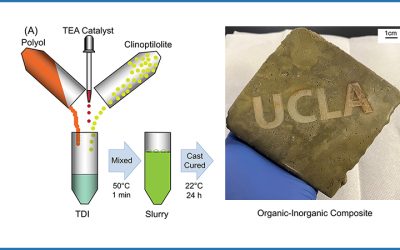

UCLA Researchers Create High-Strength Composites by Upcycling Polymer Foams

A team of researchers led by UCLA chemical engineers has discovered a way to make tough and durable composite materials with strength comparable to that of cement, by recycling a common polymer foam found in sofas and mattresses.

UCLA Computer Scientist Receives $2.8M DARPA Grant to Demonstrate New AI Model

Guy Van den Broeck, a professor of computer science at the UCLA Samueli School of Engineering, has received a three-year, $2.8 million research grant from the Defense Advanced Research Projects Agency (DARPA) to lead

UCLA Researchers Part of National Science Foundation Project to Decarbonize Infrastructure

A pair of UCLA researchers are part of a five-year, $12 million research program funded by the National Science Foundation to decarbonize the full life cycles of infrastructure by optimizing and automating carbon efficiency across multiple sectors.

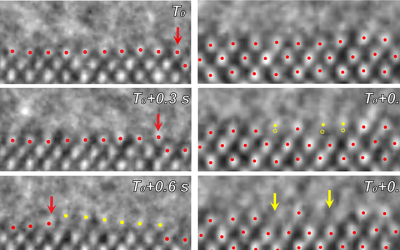

Atomic View of a Chemical Catalyst During Electrically Charged Reaction is a Scientific First

All around us are products that depend on chemical reactions aided by electricity. These electrochemical reactions are involved in manufacturing everything from aluminum and PVC pipe to soap and paper.

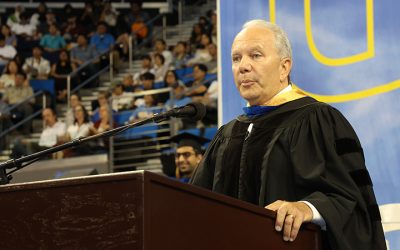

Walt Disney Imagineer and UCLA Alumnus Craig Russell Headlines Undergraduate Commencement

Former Disney Imagineer and UCLA Samueli School of Engineering alumnus Craig Russell ’80 delivered the keynote remarks at the UCLA Samueli undergraduate commencement ceremony Saturday, June 15.